With new Infrastructure Investment & Jobs Act funding coming online, state energy offices are looking for scalable, equitable ways to drive adoption of efficient appliances. One proven lever is Eco Financing—delivered at checkout through a modern utility marketplace—to remove the up-front cost barrier with low-interest microloans.

Briefing NASEO: how Eco Financing fits federal funding and equity goals

On March 17, Enervee joined the NASEO Financing Committee with partners from the California Alternative Energy & Advanced Transportation Financing Authority (CAEATFA) and the New York State Energy Research & Development Authority (NYSERDA). We covered how microloan programs align with federal dollars, how they differ from PACE, and why they’re effective for historically underserved communities.

California: doubling efficiency savings—financing is central

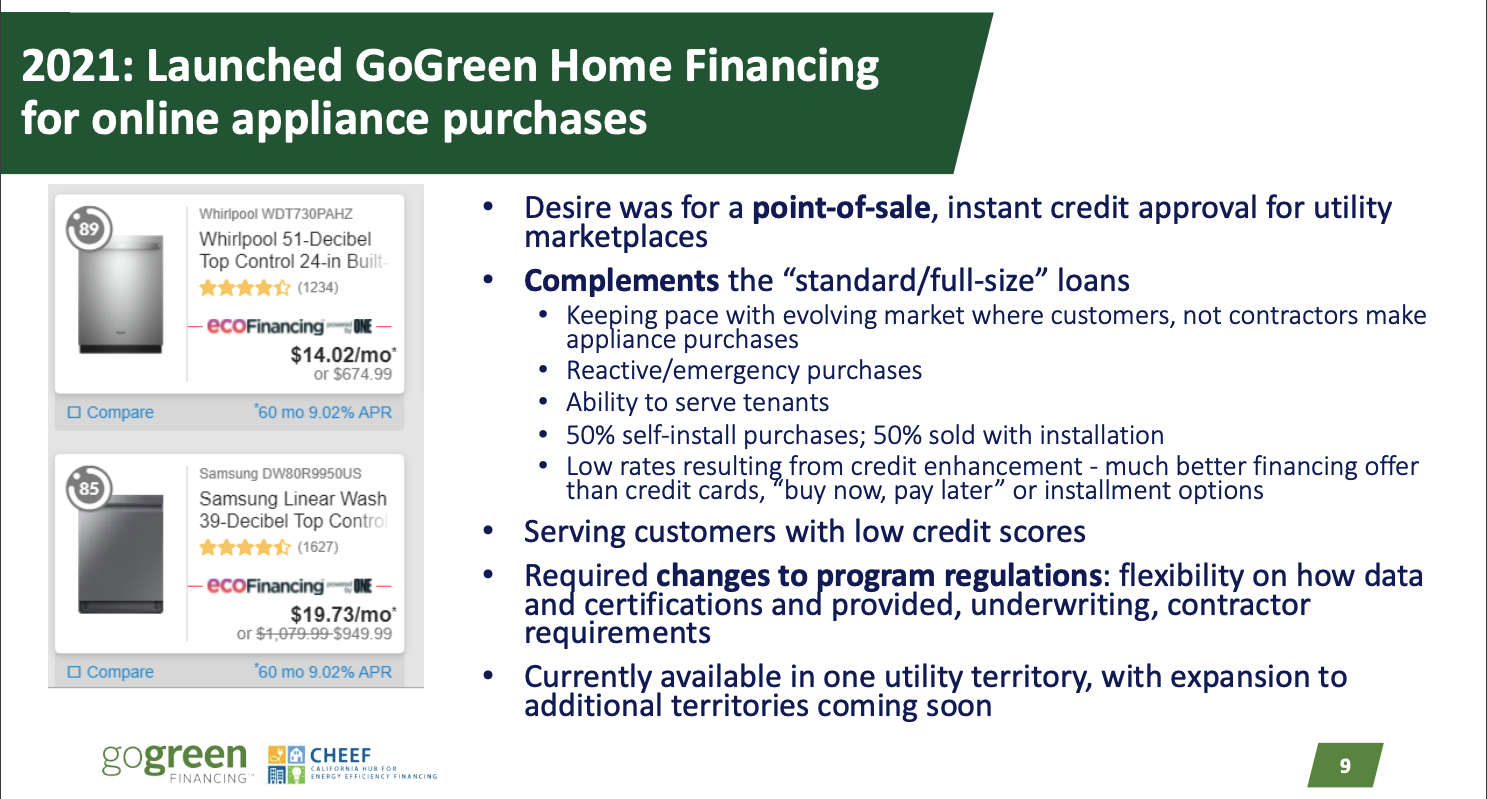

CHEEF Program Manager Miriam Joffe-Block outlined the GoGreen Home Financing program, which provides a loan-loss reserve so lenders can offer lower-rate loans to credit-challenged borrowers—enabling point-of-sale products like Eco Financing.

GoGreen partnered with Enervee to introduce a microloan pathway designed for online retail: instant credit approval at checkout on a utility-branded marketplace. It complements traditional whole-home loans by influencing one-off appliance purchases that typically happen at retail.

Eco Financing was the first microloan product supported by GoGreen Home [1], following regulatory updates to allow flexible underwriting, data, and certification requirements. The state’s bigger-picture goals: double building efficiency savings by 2030 and reduce GHGs 40% by 2030.

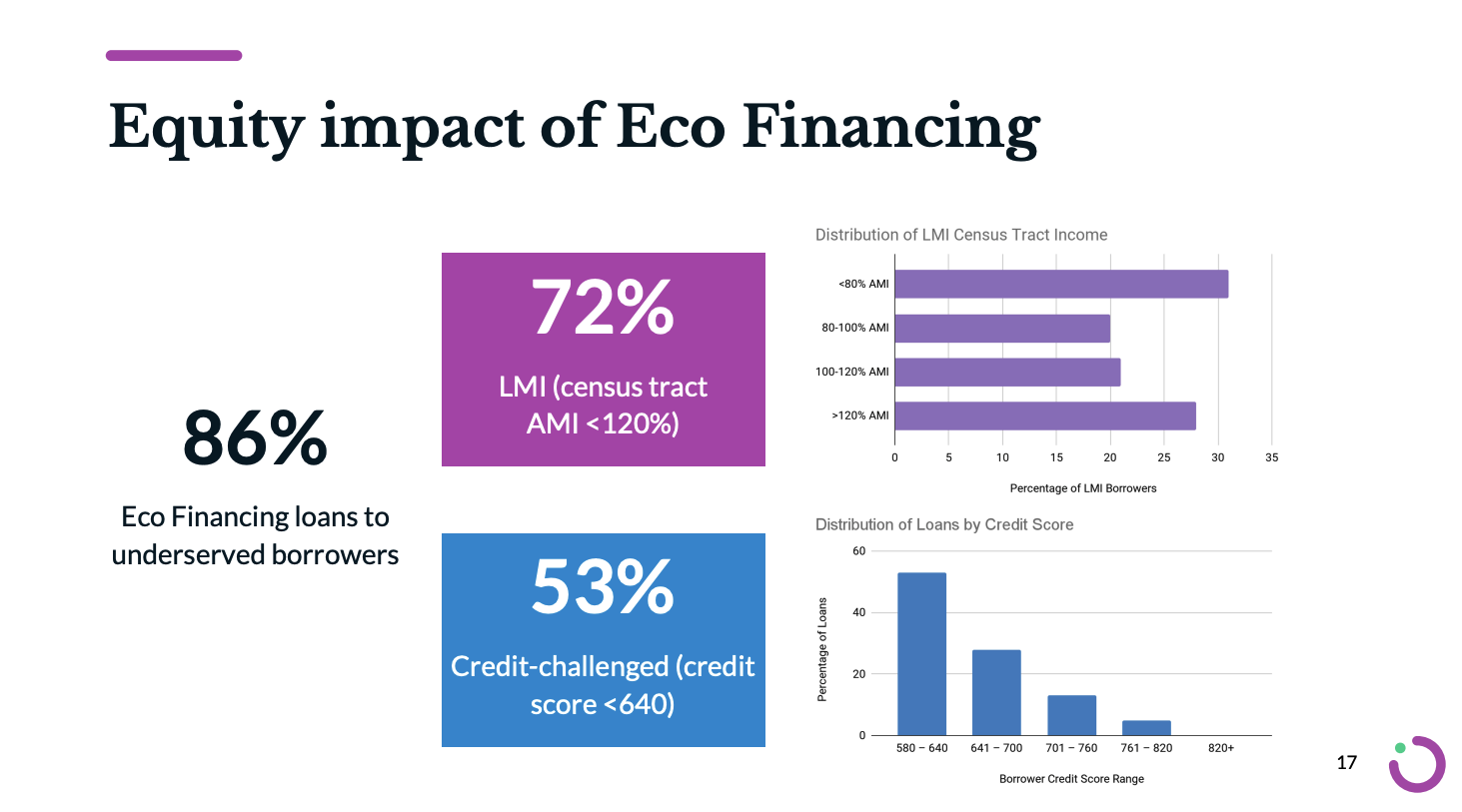

Leading with equity

Enervee’s Anne Arquit Niederberger shared early California results: 86% of Eco Financing purchases went to historically underserved borrowers. Nearly two-thirds were in LMI census tracts and over half had credit scores < 640—clear proof that point-of-sale financing can reach customers least served by traditional rebates.

New York: statewide efficient marketplace with Eco Financing

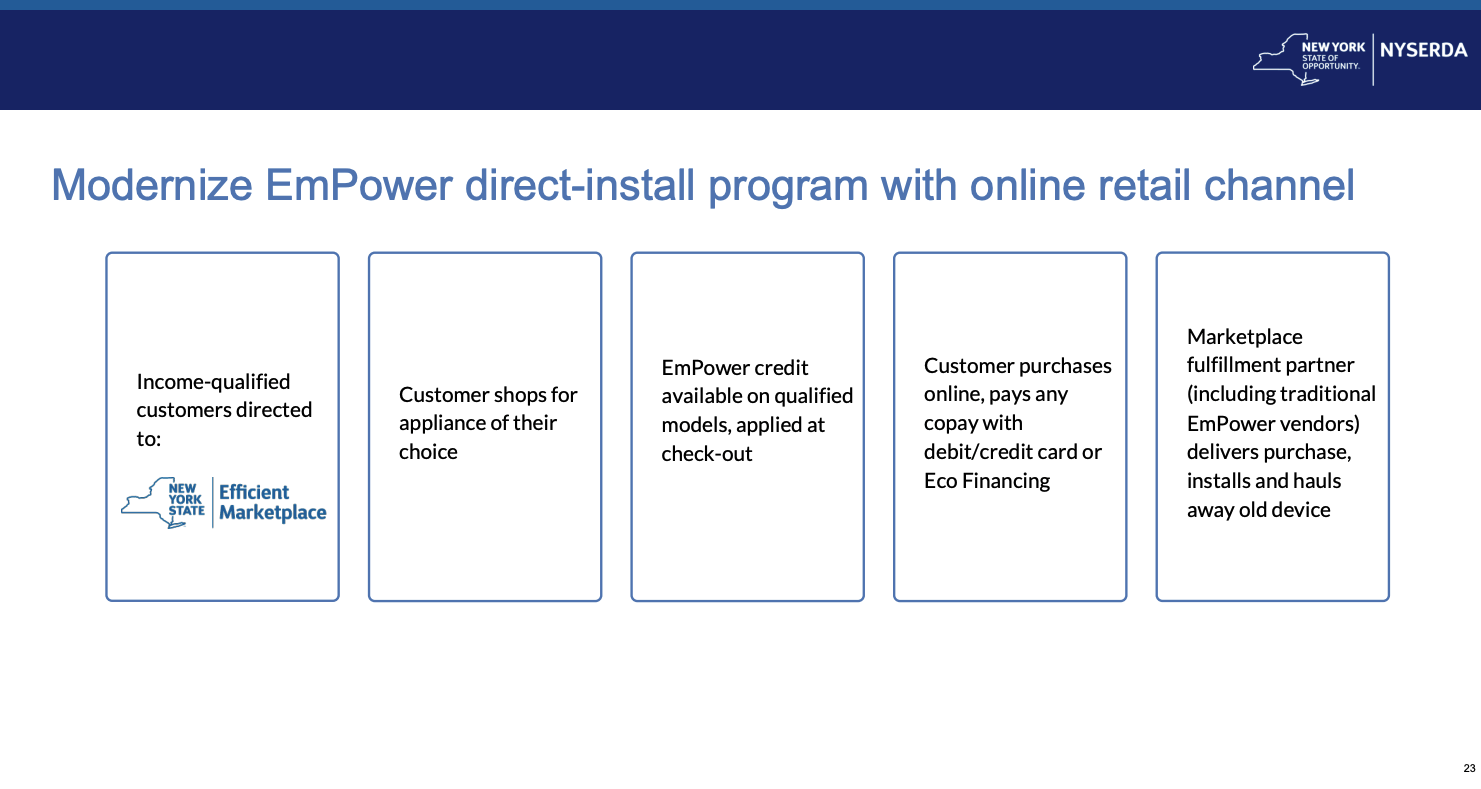

This spring, NYSERDA is launching a statewide Efficient Marketplace featuring Eco Financing. Director Chris Coll described their focus on equity and on modernizing direct-install programs. With only ~1% of LMI households reached annually by traditional designs, NYSERDA aims to scale access with a single statewide site.

- Loan-loss reserve to lower rates, with a carve-out for at least 35% of loans to income-qualified or credit-challenged borrowers.

- Integrated experience: shop efficient appliances, apply EmPower credits at checkout, and pay with Eco Financing on the same platform.

What’s next: expanding to more states

We’re eager to partner with additional state energy offices to bring the benefits of Eco Financing to millions more Americans—meeting customers at the moment of need and converting intent into action via a utility marketplace.