According to a much-anticipated independent assessment performed by Research Into Action [1], Pacific Gas & Electric (PG&E) company’s Marketplace trial nudged purchasing decisions through the end of 2017 that will result in 120–328 GWh gross lifetime electricity savings and 7–20 million therms natural gas savings.

And these savings were achieved without providing any financial incentives, resulting in cost savings of roughly 10X for electricity and 40X for natural gas [2].

From Program Theory to Quantified Impacts

Enervee’s online choice engines (commonly referred to as “marketplaces”) — the most publicly visible part of our IDEAL Customer Platform — were first deployed with utilities in the United States in 2014. They put information on consumer product energy efficiency, personalized energy bill savings & total cost of ownership, eligibility for utility rebates, retail prices, where to buy online & in local stores, user & professional reviews, as well as full product technical specifications, at the fingertips of shoppers. On one site. Seamlessly.

They allow consumers to choose the efficient appliances that myriad surveys show people actually aspire to buy. And we expect that they’ll do so, when given the opportunity [3].

Theoretically. But actions speak louder than words.

So, are utility marketplaces powered by Enervee actually nudging visitors to buy more efficient products? This was the question that Research Into Action was tasked with investigating.

We’ve reported on a series of randomized controlled trials that prove out this hypothesis, and we’ve also shared in-house research that shows that marketplace visitors are considering and actually purchasing more efficient products. But, for the first time, an independent assessment of marketplace impact has been published.

Using well-accepted evaluation techniques, the independent evaluability assessment of the PG&E Marketplace confirmed that it impacted the consumer product appliance market and consumer choice over the initial 3-year emerging technology trial period (March 2015 through December 2017), as hypothesized [4]:

- Almost 10% of PG&E’s 5.2 million residential customers have visited the Marketplace.

- The unique value of the appliance choice engine was touted by shoppers, who found the Energy Score (78%), integrated rebate sign-up functionality (70%) and personalized energy bill savings (69%) and ClearCost, cost to buy and operate model (62%) to be helpful or extremely helpful in facilitating their shopping experience — none of which can be found on conventional ecommerce sites.

- The PG&E Marketplace helped shoppers save between 15.3 and 41.9 GWh of gross first-year electricity and 592,993 to 1,629,499 gross first-year therms [3]. On a lifetime basis, the gross savings were between 158.7 and 434.6 GWh electric and 8,221,273 to 22,576,096 therms natural gas.

- Most of these savings (77% of gross first-year electricity savings and 88% of natural gas savings) were attributed to the market transformation/ behavioral strategies embedded in the design of the Marketplace itself, backing out any potential effects of mid- and downstream incentive programs.

Relative Scale of Marketplace Impacts, Without Incentives

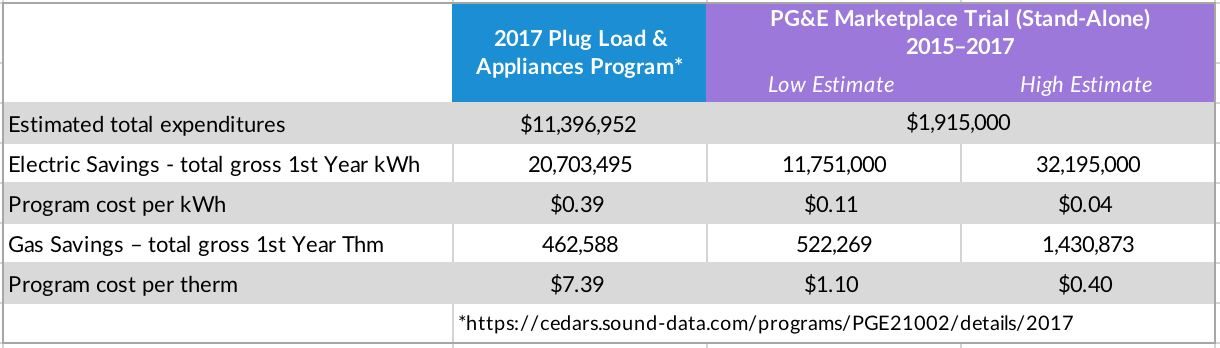

To put the estimated impacts of the PG&E Marketplace into perspective, electricity savings on a first-year basis over the 2015–2017 trial period were similar to the savings claimed for PG&E’s Plug Load & Appliances (PLA) program in 2017 (see table). And first-year natural gas savings from the Marketplace trial were up to 3X greater than the claimed 2017 PLA program gas savings.

PG&E’s Marketplace trial will result in savings over the lifetime of products, delivering a total of between 120–328 GWh gross lifetime electricity savings and between 7–20 million therms natural gas savings.

And these impacts could be scaled – and the specific costs per unit of energy saved further reduced – by stepping up marketing.

Favorable Program Costs

The PG&E Marketplace Trial program costs included in the RIA study [2] are nearly six times lower than those of the PLA program. The table above shows the respective costs per unit of energy saved on a first-year savings basis, assuming that 70% of program costs went to achieving the electricity savings and 30% to achieving the natural gas savings. Electricity savings achieved by the Marketplace cost 3 to 9 times less per kWh and natural gas savings cost 6 to 18 times less per therm than the PLA portfolio.

Using the same budget allocation assumption, on a lifetime savings basis, the PG&E Marketplace achieved electricity savings at a cost of between $0.004/kWh and $0.011/kWh and gas savings at $0.028 to $0.078/therm (in the RIA study, all costs were attributed to electricity savings, even though significant gas savings were also achieved).

The PG&E Marketplace is highly cost-effective, because it relies on market transformation and behavioral nudging strategies, which expands the scope of plug load & appliance categories that can be addressed and eliminates the need to provide product rebates, as well as related rebate processing costs.

The significance of these results cannot be overestimated.

California aims to double the cumulative energy efficiency savings achieved in 2030 to over 80,000 GWh of electricity, relative to an already aggressive baseline, and the main source of residential load growth is devices that plug into power outlets (plug loads), which are notoriously difficult to address with conventional programs.

According to California Energy Commissioner Andrew McAllister [5]: “Plug loads are a key area where we lack solutions. A marketplace, like Enervee, can provide data on what influences consumer’s shopping choices.”

As a result, the State of California has acknowledged the importance of finding solutions for plug load growth and has embraced utility online marketplaces as a key strategy [6].

This study is the first actually to quantify the impact of a utility online marketplace, independent of any incentives, lending confidence that this innovative market transformation strategy, grounded in behavioral economics, can help California reign in residential load growth.

Scaling Savings – Efficient Markets, Behavioral Nudging and Targeted Incentives

Given that Enervee operates marketplaces for all four California independently owned utilities and the Los Angeles Department of Water & Power, considerable energy savings can be achieved statewide – simply by making product energy efficiency visible, personalized and actionable for consumers. In-house research has shown that when the market is transparent, people are eager to purchase efficient products that don’t cost more to buy [3].

This, in turn, should send a loud signal to manufacturers and retailers that the market demands more efficient products.

…and that market intermediaries who help consumers choose the efficient products they aspire to stand to win. The RIA study found that for 46% of PG&E Marketplace visitors, the value added online experience improved their perception of their energy provider overall, consistent with earlier research [4].

Enervee is already busy building an efficient shopping ecosystem, in partnership with leading retailers, manufacturers and publishers of professional product reviews nationwide [7].

From this foundation of more efficient markets and taking full advantage of our ability to nudge consumers towards better purchases, Enervee hopes to work with our utility clients in California and elsewhere to experiment with intelligently targeted incentives. As more savings are achieved without financial incentives, more ratepayer efficiency funds can be spent where they have the greatest impact, namely to:

- Drive product innovation, by only incentivizing the most efficient products;

- Benefit income-constrained households and disadvantaged communities, which will reduce bill subsidy payments;

- Optimize grid benefits, with geo- and time-limited incentives.

These strategies are well aligned with the recent guidance on use of incentives that the California Public Utilities Commission gave to utilities in the process of approving their 10-year energy efficiency business plans [8].

Notes

[1] etcc-ca.com/reports/assessment-pge%E2%80%99s-online-marketplace

[2] The cost-effectiveness metrics included in the report reflect special legacy pricing extended to PG&E as Enervee’s initial client. Full pricing would result in lower cost-effectiveness, but it would still be as or more favorable than more traditional plug load and appliance program approaches, such as that presented in the table.

[3] Efficient markets drive product efficiency

[5] calenergycommission.blogspot.com/2017/08/making-energy-efficiency-part-of.html

[6] For example, the 2016 Existing Buildings Energy Efficiency Action Plan Update and the CPUC mandate that all utilities under their jurisdiction offer their customers online marketplaces.

[7] Kenmore Integrates Enervee Charge

[8] docs.cpuc.ca.gov/SearchRes.aspx?docformat=ALL&docid=212763072