As part of its efforts to assist the electric power industry in Japan with adapting to a liberalized market, the Japan Electric Power Information Center (JEPIC) published an article in the June 2017 edition of its monthly magazine Overseas Electric Power that looked into how energy supply companies in the US and Europe are working with innovative, venture-backed companies.

Enervee was pleased to be highlighted as 1 of 7 venture firms driving utility innovation, and as only one of two in the energy management space, alongside Bidgely.

The report outlined the challenges faced by utilities in jurisdictions around the world — such as shrinking demand and pressure to adopt new business models as distributed energy resources gain traction — and noted how utilities are increasingly turning to venture-backed startups to provide IoT solutions and disruptive technologies to create new revenue opportunities and improve operational efficiency.

The report noted that equity investments by electric power distribution companies had reached $1 billion by 2016. In Enervee’s case, E.ON Energy invested in our Series A round in 2015.

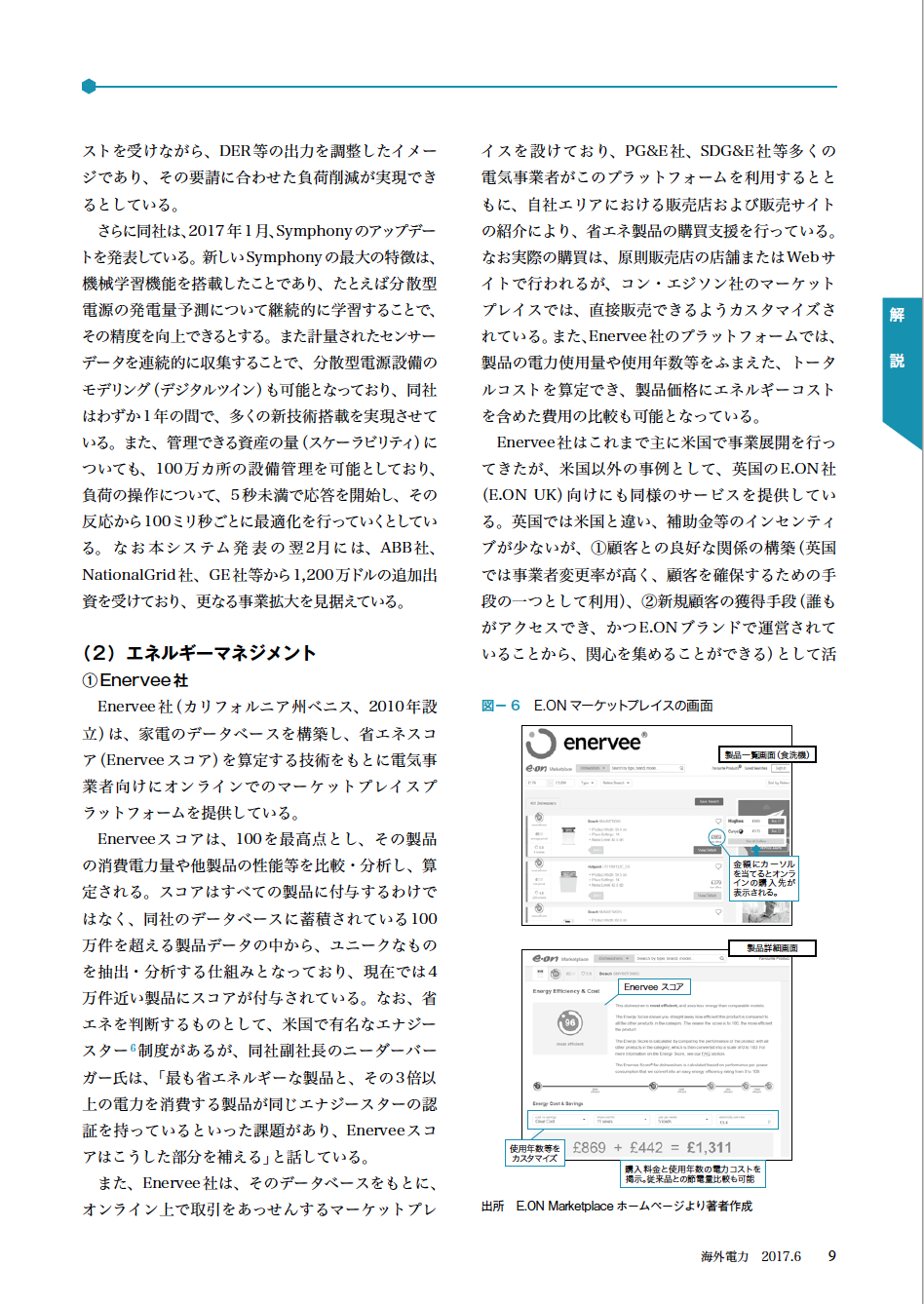

The E.ON Marketplace was featured as an example of how Enervee is leveraging its database of home appliances and relationships with retailers to provide electric utilities with an online Marketplace platform that customers value.

Keeping customers happy is of existential importance in highly competitive markets like the UK (and perhaps Japan going forward) — where acquiring new customers and keeping existing customers meaningfully engaged has a direct impact on the company’s bottom line.

But the report also highlighted US marketplaces that Enervee operates for Con Edison, Pacific Gas & Electric and San Diego Gas & Electric, where other drivers, such as regulatory requirements and customer energy efficiency targets, are in play.

Regardless of the competitive landscape and value drivers affecting a given utility, the report rightfully highlighted the importance of the Enervee Score in simplifying the shopping process, by making efficiency visible to consumers. Despite broad recognition of the ENERGY STAR label, the report pointed out that there can be a wide range in efficiencies across products carrying the label, so the complementary, more granular and daily updated Enervee Score helps consumers pick the most efficient products*.

JEPIC concluded that Japanese utilities can also benefit from partnerships with venture-backed startups like Enervee, but will need to adapt the way they do business, including speeding up decision-making processes, in order to tap into this important innovation channel.

This advice is in line with Accenture’s recent report “Partner or Perish”, which I reported on in a blog post last month.